when is capital gains tax increasing

13350 of the qualified dividends and long-term capital gains 83350 70000 is taxed at 0. The Finance Act of 2022 Finance Act has amended the Income Tax Act ITA by increasing the rate of capital gains tax CGT from 5 percent to 15 percent.

Steps Advisors Could Take Ahead Of Potential Changes In Capital Gains Tax Law Aperio

If you sell stocks mutual funds or other capital assets that you held for at least one year any gain from the sale is taxed at either a 0 15 or.

. Capital gains are the profits you make when you sell a stock real estate or other taxable asset that increased in value while you owned it. Capital Gains Tax is a tax on the profit when you sell or dispose of something an asset thats increased in value. Assume the Federal capital gains tax rate in 2026 becomes 28.

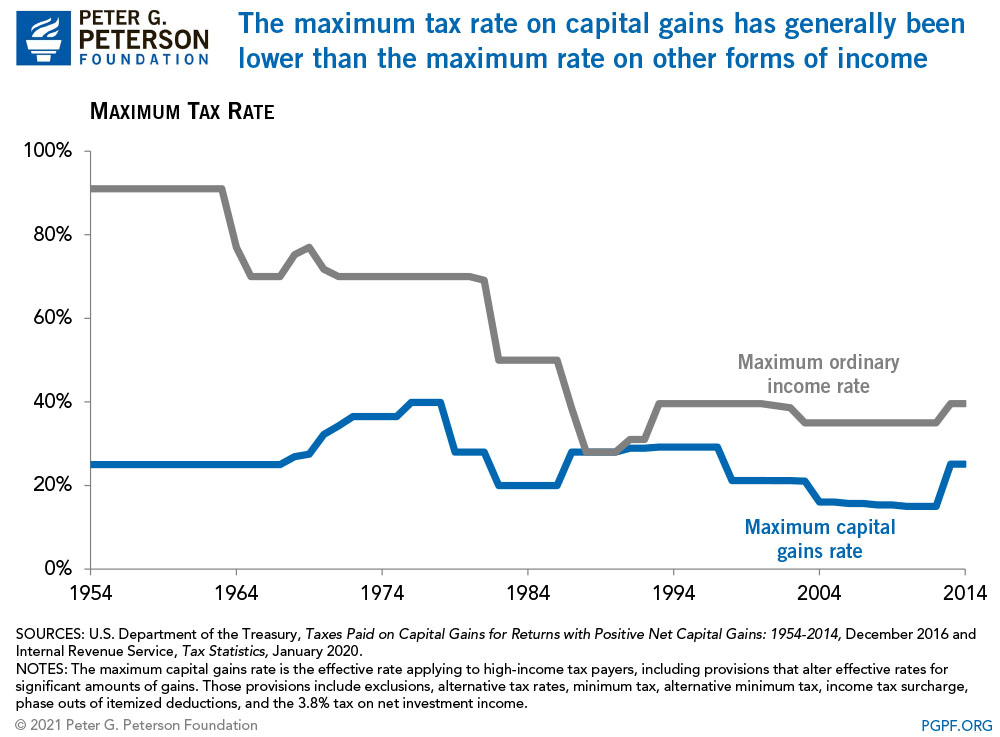

Long-Term Capital Gains Taxes. The current tax preference for capital gains. Understanding Capital Gains and the Biden Tax Plan.

Both have proposed increasing tax rates for capital gains as one potential way to generate revenue for this purpose. The capital gains tax is based on that profit. Which capital gains tax rate applies to 2023 long-term gains will depend on your taxable income.

The IRS has increased the taxable income thresholds for the 0 15 and 20 long-term capital gains brackets for 2023. The maximum zero rate amount cutoff is 83350. Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income.

Its the gain you make thats taxed not the. Jeremy Hunt should follow them and raise. The two biggest tax-cutting Conservative Chancellors in British history both increased capital gains tax - and for good reasons.

Rocky Mengle Senior Tax Editor. With higher standard deductions and taxable. A taxpayer has a 1 million long-term capital gain on December 31 2021 and invests it into an Opportunity Zone Fund.

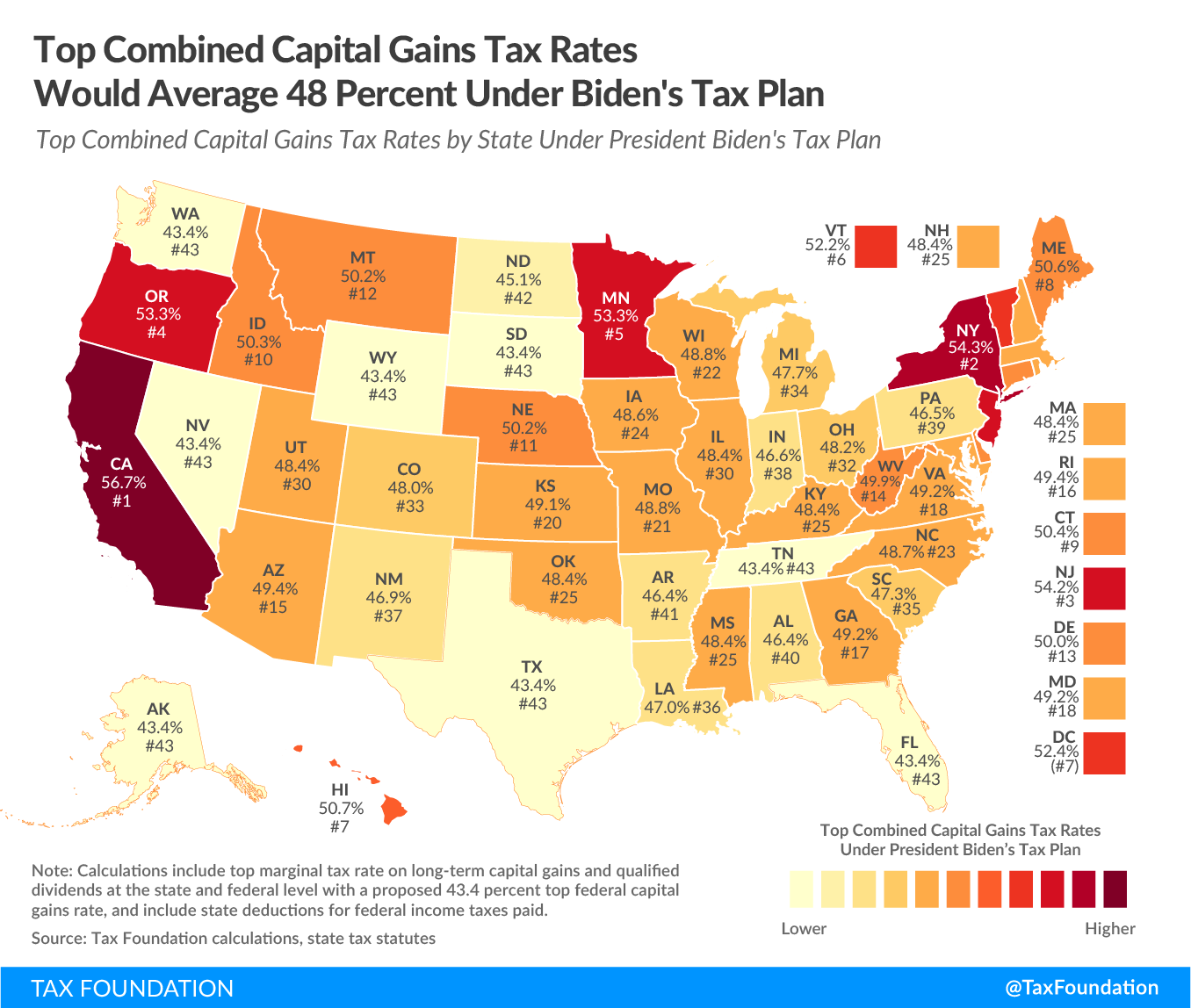

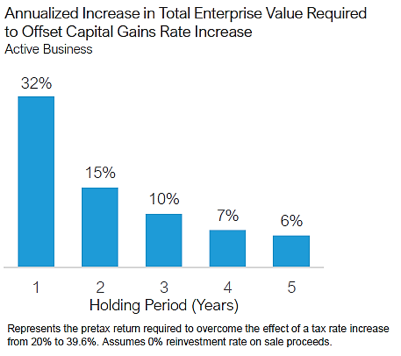

The capital gains tax rate increase to an effective rate of 434 the proposed 396 rate plus 38 net investment income tax would put a lot more pressure on recognition. To address wealth inequality and to improve functioning of our tax system tax rates on capital gains income should be increased. House Democrats on Monday proposed raising the top tax rate on capital gains and qualified dividends to 288 one of several tax reforms aimed at wealthy Americans to.

Biden proposed raising the top capital gains tax from 20 to 396 before a joint session of Congress on April 28. If you sell stocks mutual funds or other capital assets that you held for at. The Finance Ministry is set to extend the suspension of the capital gains tax on property transactions as on the one hand it wants to.

Long-term capital gains or appreciation on assets held for.

Why A Capital Gains Tax Increase Would Be A Massive Jobs And Wealth Killer Foundation For Economic Education

Biden Capital Gains Tax Rate Would Be Highest In Oecd

Biden Capital Gains Tax Plan Capital Gain Rates Under Biden Tax Plan

/cloudfront-us-east-2.images.arcpublishing.com/reuters/QRAP24VABROIFGKCBPV7AIHPPI.jpg)

Biden To Float Historic Tax Increase On Investment Gains For The Rich Reuters

Capital Gains Tax Hike And More May Come Just After Labor Day

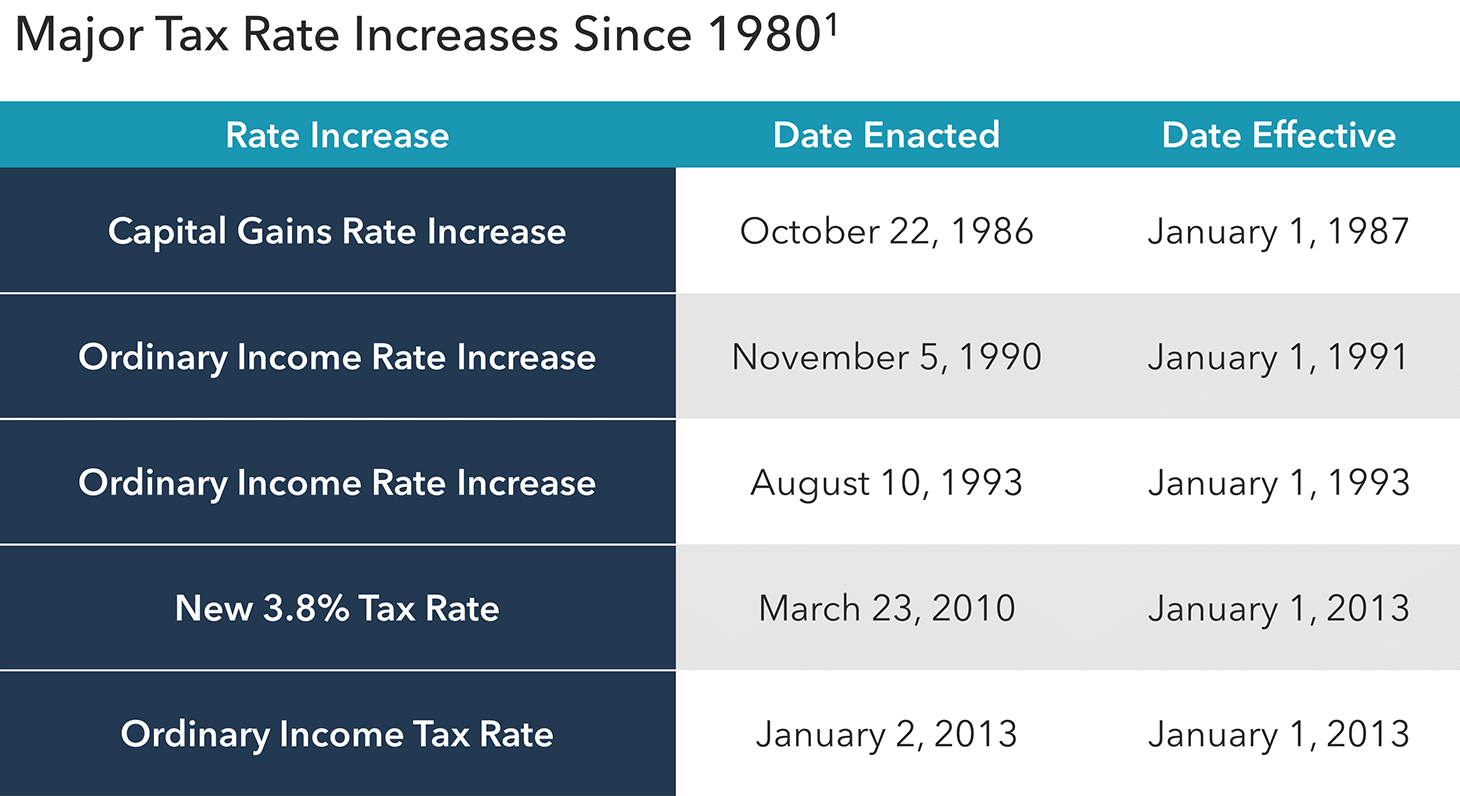

Tax Increases Are Coming Or Are They Bny Mellon Wealth Management

Private Equity Faces Increase In Capital Gains Tax Rate Our Insights Plante Moran

What S In Biden S Capital Gains Tax Plan Smartasset

A Near Doubling Of The Capital Gains Tax Rate May Be On The Horizon Wealth Management

Increasing The Capital Gains Tax Penalizing Initiative Enterprise And Not Just The Rich

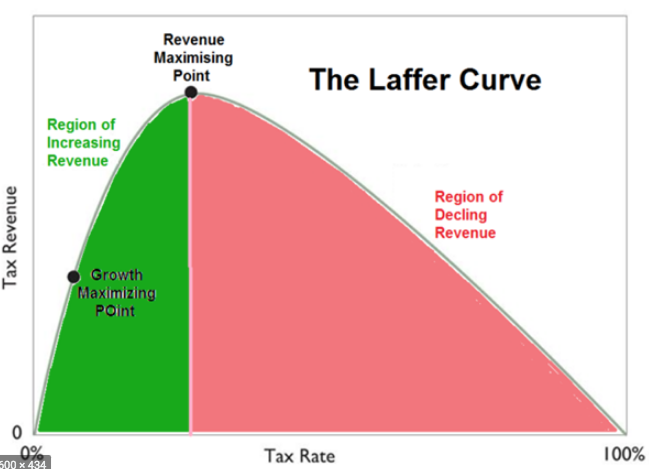

Do Capital Gains Tax Increases Reduce Revenue Committee For Economic Development Of The Conference Board

A Probable Capital Gains Tax Rate Increase And The Potential In Opportunity Zones Caliber

S P Stock Market Performance And Capital Gains Tax Increases Human Investing

Biden To Propose Capital Gains Tax Hike

Capital Gains Cuts Are Just Another Con To Benefit The Rich Mother Jones

Biden S Capital Gains Tax Increase Is More Unproductive Misdirection The Hill

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

Biden S Tax Plan Would Raise Capital Gains And Eliminate Stepped Up Basis